OCBC WISMA ATRIA

SINGAPORE

Client / OCBC Bank

Sector / Finance Institutions

Service / Experience Design, Spatial Design

OCBC Wisma Atria turns mundane banking errands and potentially overwhelming wealth management considerations into experiences of discovery and learning through its open and inclusive design.

The meandering bookcases not only encourages customers to explore different parts of the bank, it also sparks meaningful life-related conversations. It is through such conversations that the bank is able to better support customers in making informed wealth-related decisions.

This approach positions OCBC as a lifelong partner in supporting whichever lifestyles and life stages customers may be in, or aspire to achieve.

Photo credits: OCBC Bank, The Afternaut Group

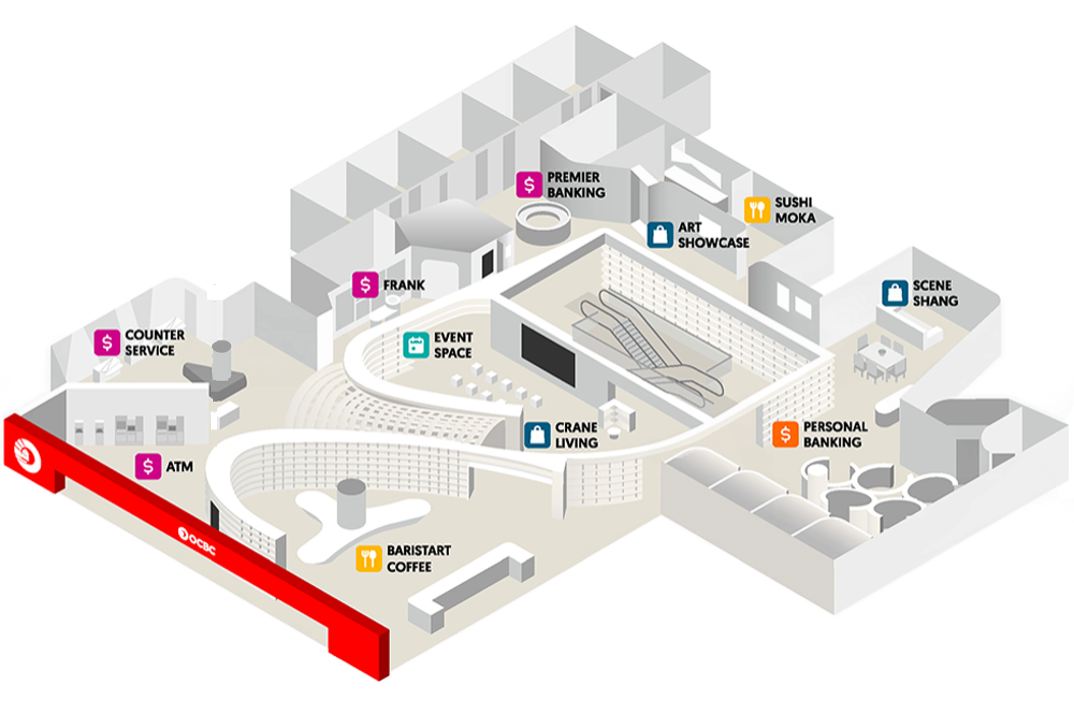

To allow the bank to become more approachable and relatable to customers, the banking elements are subtly concealed in the periphery and away from the main entrance.

Background

Driven by the desire to understand people's lives better, OCBC wanted to re-envision what the branch is, and make sure the bank is relevant to what they’re doing. Digital banking has become ubiquitous over the years, but consumers still prefer face-to-face advisory for complex banking needs like home loans and high-value wealth needs, carried out in the safe environment of bank branches.

Our design challenge was to design a space that could educate the bank’s customers about various finance topics relevant to the different stages in their lives. As a result, they will be able to make better decisions regarding their personal wealth. The space also needed to be memorable enough to entice customers to revisit whenever they like, not necessarily even for banking activities, and when they reach a new stage in their life.

Conceptualization

Together with OCBC's Customer Experience Design team, we designed the Wisma Atria branch to spark meaningful conversations that would lead to wealth-related conversations with the bank. A bookstore, café, retail, pop-up exhibition area, event space, art gallery, and sushi bar thus became unexpected, yet relevant, discoveries in the bank.

Using knowledge as a framework, the bookstore programme was interpreted as a connective spine that binds all aspects of the space, including the banking services elements, fluidly together. To allow the bank to become more approachable and relatable to customers, the banking elements are subtly concealed in the periphery and away from the main entrance. This promotes footfall by engaging customers who are not performing banking services to explore the space further and may well lead to meaningful conversations with the bank.

Design Approach

Multiple entry points to the bank were designed, bringing in visitors from the main entrance, where they would be drawn in by the books, via the cafe, or even via the third floor entrance.

Apertures within The Spine allow line of sight into different programmes, giving customers opportunities to pause along their journey. This allows the bank to distribute crowds more effectively, creating a more pleasant experience.

The array of books permeating the space connect relevant knowledge with the respective retail and lifestyle partners and present opportunities for customers to learn more about their interests. These, in turn, co-relate with the wealth related conversations that customers may have with the bank and present opportunities for deeper interactions. Such engagements are then supported by the mix of semi-enclosed and private rooms.

Outcomes

In addition to the many meaningful conversations sparked at the bank, there was also success found in hard numbers. Footfall at the bank has doubled, the number of 360 bank accounts opened has doubled as well, and credit card applications have increased by 7 times.

For further questions regarding this project, please feel free to reach out to hello@theafternaut.com for more information.

The Afternaut Group Pte Ltd. 2024

Choa Chu Kang Public Library Singapore

Choa Chu Kang Public Library Singapore